A MULTIFAMILY INVESTMENT OPPORTUNITY

● Little Rock, AR ●

DISCLOSURE

The following information is an investment summary provided to prospective investors and others. This information is not an offering to sell a security or a solicitation to sell a security. At the request of a recipient, the Company will provide a private placement memorandum, subscription agreement and the Limited Liability Company Operating Agreement. The Managing Member in no way guarantees the projections contained herein. Real estate values, income, expenses and development costs are all affected by a multitude of forces outside the Managing Member’s control. This investment is illiquid and only those persons that are able and willing to risk their entire investment should participate. Please consult your attorney, CPA and/or professional financial advisor regarding the suitability of an investment by you.

This information is confidential and may not be reproduced or redistributed. The information presented herein has been prepared for informational purposes only and is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or fund interest or any financial instrument and is not to be considered investment advice. This presentation is for institutional use only and is not to be distributed to any party other than its intended recipient.

The following materials present information regarding a proposed creation of a special purpose vehicle (the "Issuer") which would offer securities (the “Securities”) to finance its acquisition of a portfolio of financial assets to be selected and managed by the portfolio manager referred to herein (the "Manager"). These materials have been prepared to provide preliminary information about the Issuer and the transactions described herein to a limited number of potential underwriters of the Securities for the sole purpose of assisting them to determine whether they have an interest in underwriting the Securities.

The views and opinions expressed in this presentation are those of Honey Pot Investments, LLC and are subject to change based on market and other conditions. Although the information presented herein has been obtained from and is based upon sources Honey Pot Investments believe to be reliable, no representation or warranty, expressed or implied, is made as to the accuracy or completeness of that information. No assurance can be given that the investment objectives described herein will be achieved. Reliance upon information in this material is at the sole discretion of the reader.

This data is for illustrative purposes only. Past performance of indices of asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

Forward-looking information contained in these materials is subject to certain inherent limitations. Such information is information that is not purely historical in nature and may include, among other things, expected structural features, anticipated ratings, proposed or target portfolio composition, proposed diversification or sector investment, specific investment strategies and forecasts of future market or economic conditions. The forward-looking information contained herein is based upon certain assumptions, which are unlikely to be consistent with, and may differ materially from, actual events and conditions. In addition, not all relevant events or conditions may have been considered in developing such assumptions. Accordingly, actual results will vary, and the variations may be material. Prospective investors should understand such assumptions and evaluate whether they are appropriate for their purposes. These materials may also contain historical market data; however, historical market trends are not reliable indicators of future market behavior.

Information in these materials about the Manager, its affiliates and their personnel and affiliates and the historical performance of portfolios it has managed has been supplied by the Manager to provide prospective investors with information as to its general portfolio management experience and may not be viewed as a promise or indicator of the Issuer's future results. Such information and its limitations are discussed further in the sections of these materials in which such information is presented.

Past performance of indices or asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The comparisons herein of the performances of the market indicators, benchmarks or indices may not be meaningful since the constitution and risks associated with each market indicator, benchmark, or index may be significantly different. Accordingly, no representation or warranty is made to the sufficiency, relevance, important, appropriateness, completeness, or comprehensiveness of the market data, information, or summaries contained herein for any specific purpose.

TABLE OF CONTENTS

(click on the section name below to jump directly to that section)

THE TEAM

Property Management

Founded in 2004, Trinity Multifamily offers the highest quality property management service, construction, property rehab, consulting and due diligence for all of their clients. Their property management team combines the experience of ownership, development and management of multifamily apartment communities with their expertise in marketing, leasing, sales and renovation to maximize long term profitability for their owners. They manage many properties in the Southern/Midwestern United States.

With more than 50 years of combined property management experience, the Trinity Multifamily principals have developed, redeveloped, and/or repositioned more than 30,000 multifamily apartments and condominiums.

EXECUTIVE SUMMARY

We have identified The Indian Villa Apartments for acquisition.

We are offering an opportunity to partner with us on a 30-unit, Class C, garden-style one floor apartment building community. Built in 1966 on one acre of land, the complex consists of 4 buildings with 8 two beds, one bath units and 22 one bed, one bath units.

Indian Villa Apartments represents a solid and safe opportunity to invest in a proven value-add property with a significant upside.

This is a 506(b) offering, available to accredited investors AND 35 sophisticated (approved non-accredited) investors.

KEY INVESTMENT DETAILS

70/30

17.7-22.4 %

Investors/Mangers Split

Preferred Return/Annual Return

3-5 Years

Holding Period

PROPERTY STATISTICS

30

Units

$760

Avg 1-br rent in 2miles

$645

Avg 1-br rent at Indian Villa Apts

40,839 / 0.94

SF / acres

$995

Avg 2-br rent in 2miles

$719

Avg 2-br rent at Indian Villa Apts

$250K

CapEx Budget

86%

Occupancy

$58.3k

Purchase price per door

PROPERTY PROFILE

We are $115-$275/month below avg market rent for one-bedroom and two-bedroom options.

Our 3-year avg rent target post-renovation is below avg market rent today. These projections will give us a much needed buffer zone just in the case of any unforeseen circumstances, while giving us a healthy margin to outperform our projected numbers should the market normalize.

The property is situated on the north side of Cantrell Rd, where average household income is much higher, and in the same district where some of the most expensive houses are located along the river. The property is also conveniently located closed to many businesses and restaurants.

BUSINESS PLAN

Immediately upon taking ownership, we will renovate all the units to bring them up to market standard as the tenants turn over.

Luxury Vinyl Flooring (LVT), countertops, kitchen cabinets and dish washer all throughout. Heating/Cooling will be improved, as well as light fixtures and hardwares will also be updated for a more uniform modern clean look.

Exterior will also have a slight face lift to give the complex a better curb appeal. Future plan also includes security gate and security system for more exclusive atmosphere.

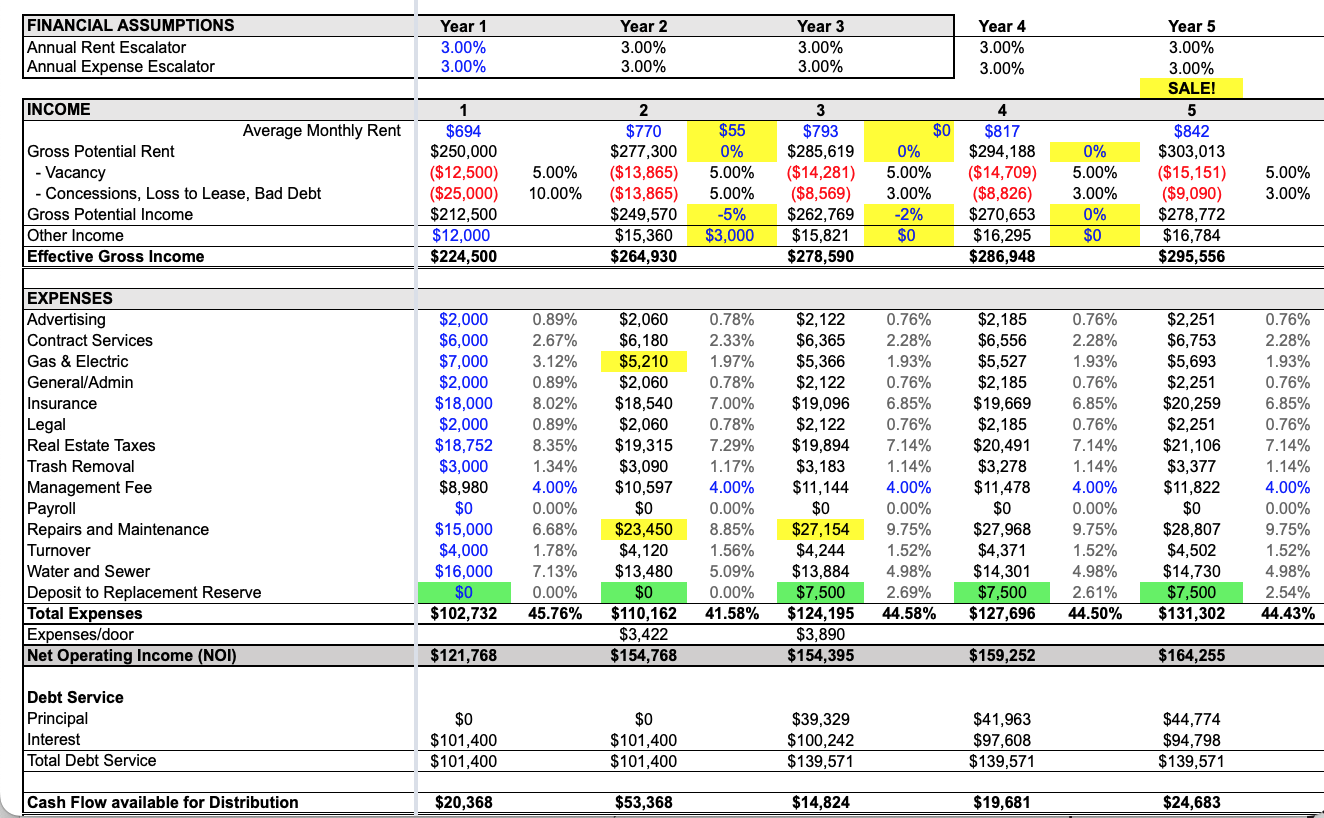

FINANCIAL ANALYSIS

MARKET REVIEW

With health care (UAMS) and local government being major employers of Little Rock, the city has seen a very steady job market with only small variations.

REAL ESTATE TERMS AND DEFINITIONS

Capitalization Rate (Cap Rate): A rate of return on a real estate investment property based on the expected income that the property will generate. Capitalization rate is used to estimate the investor's potential return on his or her investment. This is done by dividing the income the property will generate (after fixed costs and variable costs) by the total value of the property.

When acquiring income property, the higher the capitalization rate (“Cap Rate”), the better. When selling income property, the lower the Cap Rate the better.

A higher cap rate implies a lower price, a lower cap rate implies a higher price.

Cash Flow: Cash generated from the operations of a company, generally defined as revenues less all operating expenses.

Cash-on-Cash (COC): A rate of return often used in real estate transactions. The calculation determines the cash income on the cash invested.

Calculation: Annual Dollar Income Return / Total Equity Invested = Cash-on-Cash.

Debt Service Coverage Ratio (DSCR): It is the multiples of cash flow available to meet annual interest and principal payments on debt. This ratio should ideally be over 1.

Return on Equity (ROE): The amount of net income returned as a percentage of shareholders equity.

Average Annual Return (AAR) excluding disposition: The average return per year during the investment hold.

Investor Average Annual Return, including disposition: The average return per year including profits from disposition. This calculation does not include the return of invested capital.

Internal Rate of Return (IRR): The rate of return that would make the present value of future cash flows plus the final market value of an investment opportunity equal the current market price of the investment or opportunity. The higher a project's internal rate of return, the more desirable it is to undertake the project.